Despite Kenya having more than 380 Digital Credit Providers (DCPs), access to credit has remained a challenge for many small businesses in the country, with players blaming the bad precedence on predatory practices.

However, the Central Bank of Kenya (CBK) is beginning to streamline the industry. The regulator has licensed 12 more digital credit providers, a move that has seen the number of licenced digital lenders rise from 10 to 22, following the licensing of the first 10 in September last year.

This means 359 DCPs that applied for licenses last year (since March 2022) are still inactive – CBK has been working closely with them in reviewing their applications as well as involving other regulators and agencies pertinent to the licensing process, including the Office of the Data Protection Commissioner.

“Other applicants are at different stages in the process, largely awaiting the submission of requisite documentation,” CBK said.

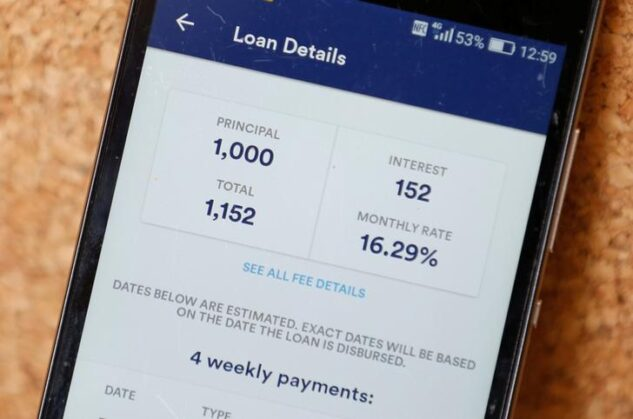

The licensing and oversight of DCPs was informed by concerns raised by the public about the predatory practices of the unregulated DCPs, and in particular, their high cost, unethical debt collection practices, and the abuse of personal information.

The list of the 22 licensed DCPs which includes the likes of Inventure Mobile Limited (Trading as Tala) and Giando Africa Limited can be accessed through the CBK Directory of Digital Credit Providers.