BY NBM WRITER

Money plays a central role in most aspects of life, and many of us are constantly preoccupied with the pursuit of financial security, particularly given the prevalent “money culture” in Kenya. Having multiple sources of income is highly valued by many, and those seeking to increase their revenue often dream of achieving this. With more young people taking on entrepreneurial roles and becoming adept at leveraging the internet and social media to run efficient and convenient businesses, it’s becoming increasingly clear that today’s youth are more financially empowered than previous generations.

Given the developments, one might wonder if young people today have the resources and knowledge needed to save and invest their money effectively in order to secure a brighter financial future. The recently concluded 11th edition of the Global money week launched by the Child and Youth Finance International Secretariat promoted financial literacy among young people and focused on the theme of “Plan your money, Plant your future.”

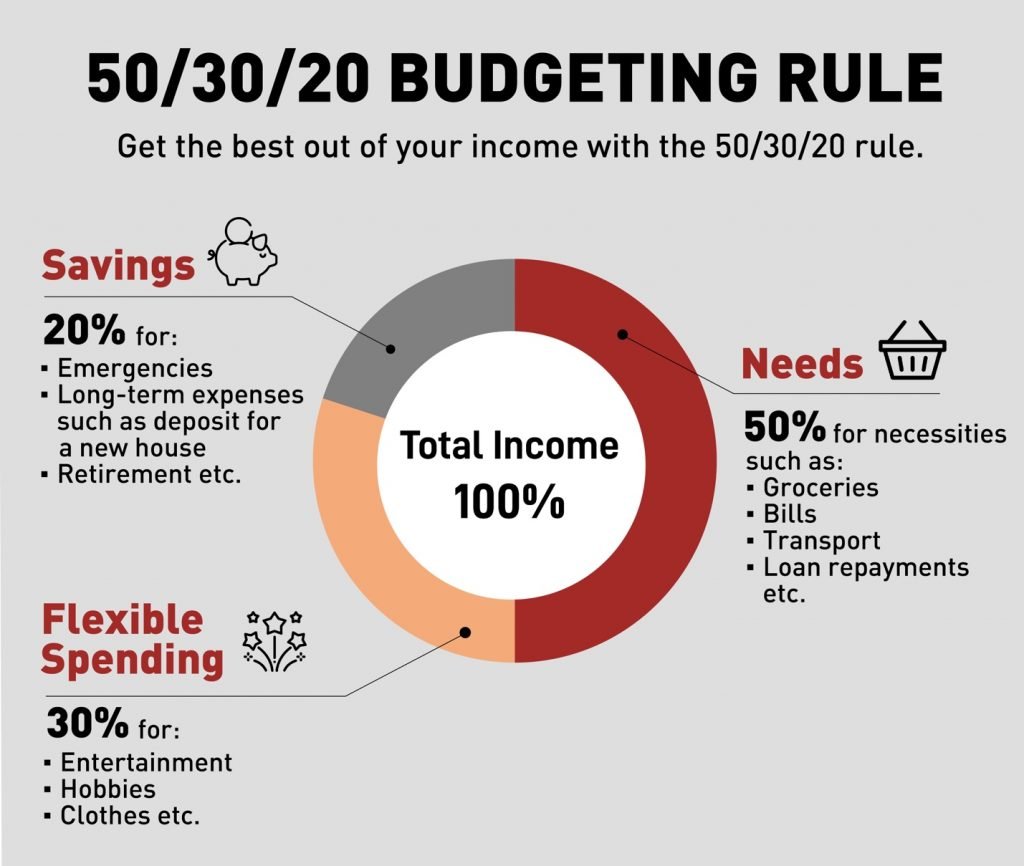

Saving 20% of one’s income is generally considered an ideal goal, but that can be a challenging goal for many. According to an analysis by EFG Hermes, Kenya’s savings rate is notably below the African average of 17%, as indicated by various studies. On the other hand, Uganda and Tanzania have already surpassed the 20% threshold, pointing to a more advanced

savings culture.

With the right approach, self-discipline and access to the right savings platforms, the savings culture can be enhanced with savings processes that have been made simpler. Most banking mobile apps provide users with fast and convenient tools for saving money.

The Safaricom app, for example, can enhance your savings efforts thanks to its M-shwari, a savings and loan product, and Mali products. Equity bank’s mobile app is another good example – with the app, a user can schedule regular payments into his/her savings account thus one will never miss a deposit. Other money saving platforms include Chumz, Branch finance app, and KCB mobile app.

Additionally, to foster a savings culture amongst yourself and your peers, consider creating a savings calendar where each individual can save on a daily, weekly, bi-weekly or monthly basis. This approach not only fosters a sense of accountability amongst peers but it also reinforces a habit of saving regularly.

We are currently witnessing a generation of business-oriented youth who are leveraging diverse channels, – including online platforms and physical businesses spanning various sectors, such as agriculture –, to make a living. This trend is a positive development, as it signals a shift from traditional professions and businesses as the sole means of earning a living. However, for the success of any business, financial literacy and planning is critical.

Regular training on money management, budgeting, debt management and business strategy is essential to ensure sustained business growth. Financial literacy plays a critical role in business success. Equity Group Foundation, for instance, offers training programs for young entrepreneurs to ensure the sustainability and growth of their ventures. This means that young entrepreneurs seeking to expand their businesses or an individual seeking to make more informed financial decisions for a brighter tomorrow, should enter into partnerships that will not only facilitate the scaling up of their operations, but also help them meet their goals.