After the election win in August 2022, the economy was crucial for the Kenya Kwanza political alliance headed by President William Ruto. At the time, 2023 was expected with a lot of optimism as many were looking forward to a thriving economy. However, what awaited Kenyans was the rising cost of living and new policies.

It is sad that the government has yet to reward voters by making changes that would reduce the cost of living, promote businesses, create opportunities, and improve the economy. There has been utter confusion with one change after another, and Kenyans are not happy.

While the government has defended itself by saying that the changes are necessary for the economy to recover, it seems unaware of how much new policies and amendments are hurting the economy.

The year 2023 began with an adverse economic environment in Kenya, characterised by a reported inflation rate of 9.5% and fluctuating forex rates, with the Kenyan shilling standing at Sh123.48 against the dollar as of January 5, 2023.

These resulted from the government removing the fuel and food subsidies in 2022 that supported the country while it faced impacts of geopolitical tensions and was in recovery from the pandemic. The new administration was not done with its amendments; what followed was unexpected.

In 2022, the National Social Security Fund (NSSF) Act of 2013, which looked to increase the NSSF rates, was declared unconstitutional by a three-judge bench of Mathews Nduma, Hellen Wasilwa and Monica Mbaru at the Employment and Labour Relations Court.

Interestingly, on February 3, 2023, the Court of Appeal ruled that a lower court did not have the jurisdiction to hear a case challenging the validity of the new contribution rates. This overruled the judgement, making the Act legal and allowing the government to enforce it. The government did not waste time as the updated NSSF rates took effect from the payroll month of February 2023.

Under the NSSF Act No. 45 of 2013, a lower earnings limit (LEL) for employees who make less than Sh6,000 and an upper earnings limit (UEL) for employees who earn Sh18,000 or above was introduced. The monthly matching contributions by both employees and employers rose from the current Sh400 to 12% of a worker’s monthly pensionable income (6% from the employee and 6% from the employer), with a maximum contribution of Sh2,160 for workers earning more than Sh18,000 per month.

Several parties, such as the County Pensioners Association, tried to appeal the ruling at the Supreme Court, but the Court declined to stop the deduction of the new National Social Security Fund (NSSF) rate increase. The new government was not done with its additions and changes, so it appeared. Having proposed and debated the Finance Act 2023, President William Ruto finally signed it into law on 26 June 2023 and gazetted it the next day.

Additions and amendments

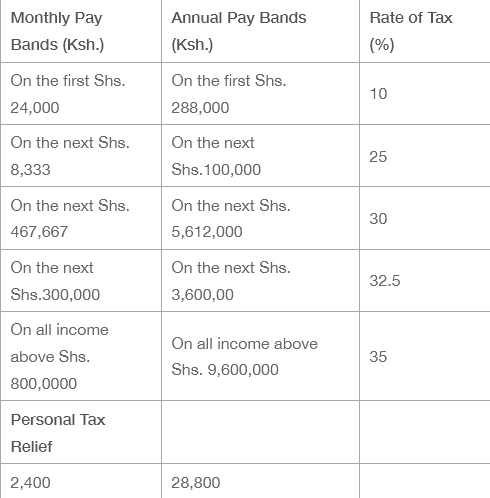

With it came a number of tax additions and amendments, and the government revised the individual income tax brackets and rates. The tax rate for individuals earning up to Sh24,000 monthly is 10%. This is 25% for those earning between Sh24,000 to Sh32,333.33, 30% for those between Sh32,333.33 and Sh500,000, 32.5% for those between Sh500,000 to Sh800,000 per month is 32.5%, while those earning above Sh800,000 per month are taxed at 35%. These changes took effect from 1 July 2023.

There were changes to the turnover tax rate as well; it was increased from 1% to 3%, while the upper threshold of the turnover tax was reduced from Sh50 million to Sh25 million. This change, which took effect from 1st July, saw many businesses earning more than Sh25 million but less than Sh50 million. They have to now deal with turnover tax, increasing their expenditure at a time when the business environment was unconducive to many.

One of the most worrisome additions in the tax was the doubling of the tax on petroleum products, from 8% to 16%, which also took effect on 1st July. In addition to the impact of global factors, this saw the rise of fuel pass the Sh200 mark and even threaten to reach Sh300 as the price of goods and services reached new heights.

There was the introduction of the digital asset tax rate, which is set at 3% of the transfer or exchange value, and it is the responsibility of the platform owner to deduct and remit the tax to the Kenya Revenue Authority (KRA) within five working days. The act termed digital content monetisation as various forms of electronic material, including advertisements on websites and social media platforms, sponsorship agreements, affiliate marketing, subscription services, licensing of content, and crowdfunding.

Another significant change in the Act is imposing withholding tax on payments made to resident and non-resident digital content creators. Payments made by resident persons now attract a withholding tax rate of 5%, while payments to non-residents are subject to a withholding tax rate of 20%. This new provision seeks to capture income from Kenya’s growing digital creative economy. A provision was also introduced that any person supplying imported digital services over the internet, electronic networks, or through a digital marketplace must register for VAT, regardless of whether their taxable supplies meet the turnover threshold of Sh5 million.

Furthermore, the act introduced new rules regarding the taxation of gains. Gains accrued from property transfers in Kenya, alienation of shares or comparable interests derived from immovable property in Kenya, and alienation of shares in Kenyan resident companies are now subject to capital gains tax. The government also introduced a 5% withholding tax on local sales promotion, marketing and advertising services offered by resident persons.

Housing levy

A mandatory housing levy was introduced to be contributed by both the employer and employee. For each employee, the employer must remit its contribution of 1.5% of the employee’s monthly gross salary as well as their contribution, the employer’s, of 1.5% of the employee’s gross monthly wage. The move was effective from 1st July 2023 and was to be remitted by the 9th day of the month. Additionally, the rental income tax rate was reduced from 10% to 7.5% for residents, effective January 1, 2024.

The new administration also proposed introducing a new fee-for-service model whereby Kenyans are required to pay for various government services at the Huduma centres across the country, previously provided free of charge. The government also proposed increasing service fees for things such as driver’s license renewal and duplicate national identity cards.

The government had already gazetted several changes, such as the introduction of a fee of Sh1,000 on acquiring ID cards, which were obtained for free by first-time applicants and increasing the fee for obtaining passports, for instance, fee for application of the standard 34-page passport had been set at Sh7,500 from the current Sh4,500, before revoking them.

All these changes have seen the lives of Kenyans become more complicated as the cost of goods and services has reached new heights, the economy has slowed down greatly, and the unemployment rate is through the roof. According to Kim Mworia, a financial analyst, Kenyans have been forced to part with more of their income, which has not increased, while dealing with the increase in the cost of living due to the combined effect of the new taxes and amendments.

The government has defended its decision on the additions as necessary measures to reduce the country’s reliance on borrowing. With Kenya’s public debt reaching Sh9.4 trillion ($67 billion), the government has been aiming to address the high risk of debt distress. However, as 2023 ends, these changes have not been able to produce the results expected by the government. Implementing these new taxes and increased fees has caused discontent among Kenyans, including supporters of President William Ruto, who promised to alleviate the burden of living expenses.

According to Aly Khan Satchu, an economist, the new tax law represents the highest tax rates across different income segments, placing an additional burden on already struggling individuals and businesses.

Many citizens are struggling to afford necessities and are experiencing the harsh reality of rising prices. On the other hand, employers have cried foul as they have to part with more, from the additional housing levy to the increase in taxes. As a result, the housing levy issue was taken to court, whereby the High Court declared it was unconstitutional for being discriminatory and creating unequal principles in November 2023. Even though the court later suspended its judgment until January 10, 2024, following an appeal from the Kenya Revenue Authority, Attorney General and Speaker of the National Assembly, the judgement is, in the end, a blow to the government housing programme, which many Kenyans did not support.

The new taxes and amendments have also robbed start-ups and businesses of a conducive environment to thrive. Small businesses and large companies have been forced to lay off workers, reduce costs or, worse, shut down or move out of the country. For example, according to the Federation of Kenya Employers (FKE), the country lost 70,000 formal private-sector jobs between October 2022 and November 2023. 40% of employers are still contemplating downsizing to cope with the country’s drastic rise in operation costs.

The number of businesses closing down has also increased to new heights. According to data from the Kenya National Bureau of Statistics (KNBS), approximately 400,000 micro, small and medium enterprises (MSMEs) have not celebrated their second anniversary in the last five years, raising concern over the sustainability of this critical sector. The numbers are expected to have increased further due to the new amendments. Companies are also leaving Kenyan shores as the increased taxes make the environment unsustainable. For example, MPost recently moved its headquarters from Nairobi to Kigali, Rwanda, citing the lack of a conducive environment.

Compared to the start of 2023, Kenya is in a worse position. It is not a surprise that millions of Kenyans are moving to leave the country in search of green pastures. The recent tax increases and fee adjustments introduced by the Kenyan government are leading to more challenges than solutions. The economy is currently set to face further challenges as businesses struggle to cope with the additional tax burden. The legal challenges and public reactions highlight the need for a balanced approach that addresses the country’s financial constraints without disproportionately burdening its citizens.

Even though 2024 is expected to bring hope regarding the new start-up bill, other amendments taking effect as of the 1st of January, might cancel the positive impacts it will present. Unlike 2022, it is clear there is no mood of optimism as we close 2023 and look to 2024. Something must be done sooner than later if the current challenging situation is to change.