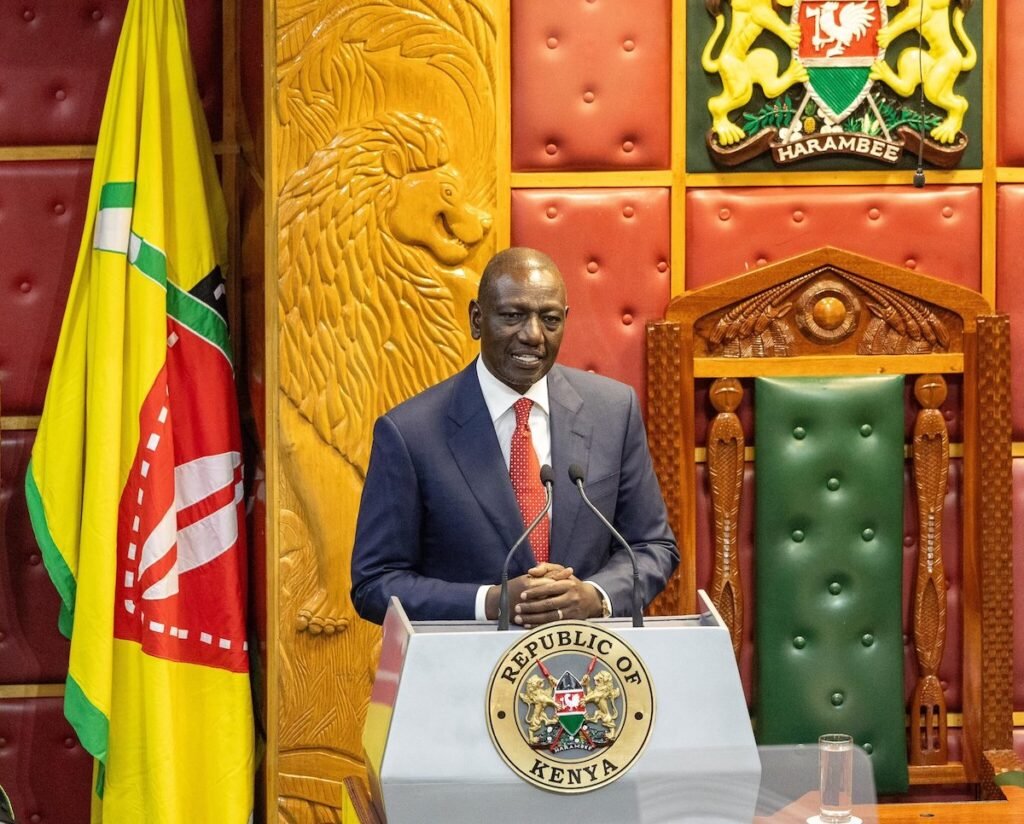

Once a year, there is a special siting where the president reports to parliament on the state of security as well as talk about accelerating economic policies as per article 132 (1)(b) of the constitution.

This time, President William Ruto believes that Kenya has put in place strategies to “eliminate wasteful subsidies”, give relief to households by reducing inflation, and ensuring that Kenyan shilling against the dollar continues to be stable.

But the irony is stark – Ruto celebrated economic expansion at a time when the households, particularly those at the bottom of the pyramid continue to grapple with rising food prices, high interest rates, and diminishing disposable incomes.

Dr Ruto explained on Thursday, November 20, during a joint sitting at the National Assembly and the Senate that Kenya’s GDP has increased to $136 billion, making Kenya the 6th largest economy on the continent. While he is confident of his regime’s economic policies, pushback from industry experts is shining.

Although there have been changes, the Kenya Kwanza regime is considered by many to be a bit off track. Churchill Ogutu, an economist with IC Group who analysed Kenya’s economy the same day Dr. Ruto delivered his address, said: “We have been hearing issues of securitization, privatization – we need to get some visibility in terms of the transactions being done. Some transparency has to be seen.”

“Sometimes we say one thing but when you see what is being done, it speaks to a different issue,” he said.

Dr Ruto said that at a time like this “in 2022, Kenya was in distress”.

“The last three years have not been easy,” he said. “High inflation… inflation had soared almost to double digits. A fuel shortage threatened to paralyse our economy as oil marketers struggled to access dollars.”

Unlike previous regimes, much of Kenya Kwanza’s manifesto supported economic growth, including setting up a sovereign wealth fund and an infrastructure fund to attract investment and reduce public debt, and privatizing state assets.

Inflation, Ruto said, had dropped from 9.6 percent in 2022 to 4.6 percent last month, while the shilling had “stabilised at Sh129 to the dollar for nearly two years.”

On the stock market the president said NSE has recorded investor wealth valued at Sh 1 trillion this year – since January 2025 –, and that foreign reserves had surpassed $12 billion, the highest in Kenya’s history.

Over Kenya’s sovereign credit rating he said: “Standard & Poor’s has upgraded Kenya’s sovereign credit rating from ‘B-’ to a firm ‘B’; our first upward revision in years.”

What can we do with Ruto’s address, particularly at a time when overall poverty rate remains close to 33 percent, with rural poverty standing at around 40 percent and urban poverty at 29 percent, according to the Kenya National Bureau of Statistics?

Dr James Mwangi of Equity Group Holdings was the first banker to urge Kenyans to go for loans, as cash piles and non-performing loans remain at record highs. He said: “I want to appeal to Kenyans… come borrow.”

For context: Kenyans are not borrowing thanks to scarce credit worthy customers; yet, all indicators are that the economy is yet to do well. The president said economy is doing well and that his critics are distorting facts. Who do we trust?

At the same time, “Mama Mboga” is at the centre of “survival” economy, lenders are appealing to customers to borrow, social media has exploded with economically unhappy users and subscribers, incomes have shrunk, and there is the aspect, and the question of the, “who is feeling the economic growth?”

The president said his critics are distorting facts. But the jury is out.