Kenya’s decline into fiscal trouble has been a long time coming. And it has never been more evident as it is now, with the rise of layoffs. In fact, as the year comes to an end, they have only intensified.

G4S and Tile & Carpet Centre are the latest companies to announce significant job cuts, painting the current grim picture of Kenya’s economic landscape. G4S Kenya Limited, a major player in the security services industry, has announced a significant redundancy exercise set to impact approximately 400 employees while Tile & Carpet Centre (T&C), a key player in the construction and interior design sector, announced an organizational restructuring within its production department at the Athi River facility, that resulted in some positions being deemed redundant.

The two join the likes of Procter & Gamble (P&G), the American manufacturer of household brands like Always and Pampers, which announced plans to lay off 850 employees in its planned exit in 2024 and Base Titanium, Australian miner, which also announced the ceasing of its operations in Kwale County by the end of year.

With the G4S stating that the redundancy will take effect from November 2024 to April 2025 and T&C stating December 2024, one thing was clear, the decisions were as a result of similar symptoms of a larger economic malaise that is gripping the nation.

The recurring themes of reduced business activity, high operational costs, and the need for strategic realignment suggest a systemic challenge facing Kenyan businesses. They are all effects of the harsh economic challenges that the current administration has played a role in creating. While campaigning and winning the hearts of voters, the current government made a number of promises including job creation. However, since taking power, the economy has been characterized by a deteriorating ease of doing business and investors fleeing the market in droves.

The current government’s fiscal policies, including its approach to taxation and public debt management, have been the key challenges being burdensome on businesses, especially affecting their profitability and sustainability. The focus on tax amendments and additions have been the best option for the government in increasing its revenue. When the finance bill was rejected by the people and the government withdrew it, many expected a rest on the reliance on taxes.

However, reliance on taxes have only increased. To date, the government continues to make numerous proposals. For example, the Public Finance Management (Amendment) (No.3) Bill (National Assembly Bill No. 44 of 2024), Tax Procedures (Amendment) (No.2) Bill (National Assembly Bill No. 46 of 2024), Tax Laws (Amendment) Bill (National Assembly Bill No. 47 of 2024), and the Business Laws (Amendment) Bill (National Assembly Bill No. 49 of 2024).

Even after missing out on the finance bill, the government has not given up on some of its clauses such as the abolition of the digital service tax in favour of a new tax known as the Significant Economic Presence Tax, the introduction of a minimum top-up tax, the introduction of taxation on infrastructure bonds as well as the proposal to amend Value Added Tax Act to remove the threshold for applying VAT apportionment formula which allows taxpayer who make 90% of zero-rated supply to claim 100% input VAT.

With businesses already in uproar of the current business environment, it is clear the worse is yet come.

These proposals once passed are set to further hinder businesses. To many in the industry, the government has failed in its duties; in implementing more business-friendly policies, including tax incentives for job-creating industries, streamlining of regulatory processes, and investing in key infrastructure to reduce the cost of doing business.

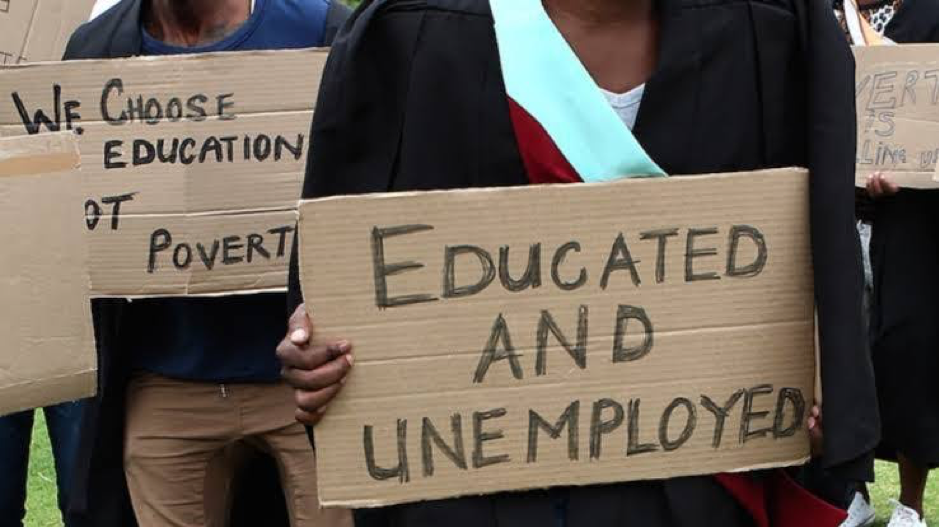

This continues to see the number of unemployed, which was already high, grow, which in turn reduces consumer spending power, as households take up measures to counter the reduced income.

What follows is a cycle, as demand for goods and services decreases affecting other businesses which are forced to reduce operations as well. With most of the challenges, businesses are facing, originating from the government, there is need for interventions to protect jobs, support affected workers, and create an environment conducive to business recovery and growth.

The government has to engage more closely with the private sector to understand and address these specific challenges.

Nonetheless, businesses are bracing for a prolonged period of economic uncertainty. Investors are already looking to our neighbors, Uganda and Rwanda as our replacements. It is clear why many Kenyans have already written off the government when it comes to effectively reversing the trend of job losses and economic slowdown.