Service data codes, popular as USSDs, open new frontier for instant payment channels in Kenya and beyond – and, in many ways, the impact has been great

Kenyans love instant payments and thus Unstructured Supplementary Service Data (USSD) comes out as a better option. Assuming that you are not connected to the internet, and still rely on a feature phone, for you to succeed in making instant payment, a Quick response (QR) code or a mobile app won’t do justice to you.

This has seen USSD-backed transactions becoming increasingly popular for mobile money and cross-domain transactions. The impact of instant cash payment options has been profound, and the trend speaks to economic factors.

For example, when your parents are financially unstable and reside in a remote part of the country where access to traditional banking services is not easy, as always, you will transfer cash to them via popular mobile financial service platforms like M-Pesa, Airtel money, Sendwave, WorldRemit, or MoneyGram.

Indeed, since M-Pesa was introduced in 2007, for example, Africa leapfrogged into mobile technology and never looked back. This innovative platform empowers users to seamlessly conduct diverse financial transactions, including money transfers and bill payments, through their mobile phones.

According to the state of inclusive instant payment system in Africa report by AfricaNenda, 75% of instant payment channels (IPS) in Africa supported USSD channels.

The report also highlights that over the years, there has been a significant change in the way people make payments, and that popularity of service codes comes down to their ease of use and accessibility, especially in regions where smartphone penetration and internet connectivity are limited – USSD still popular even in places where mobile penetration is high.

In countries where the masses rely on mobile money systems such as Kenya and Ghana, offline channels like USSD, have gained significant traction among customers compared to card-based systems. This partially due to the high percentage of people in these countries having mobile money accounts, with rates reaching 69% in Kenya and 60% in Ghana.

USSD channels have played a crucial role in facilitating transactions that go beyond traditional mobile money services, including transactions between different financial institutions. However, they are not the only instant payment channels to gain acceptance in Africa.

App channels have emerged as a close contender to USSD in terms of popularity at 72% of IPS supporting them, despite being reliant on smartphones and internet connectivity which is still far from reach for a number of Africans, especially those in rural and remote areas.

The AfricaNenda report also highlights that the adoption rates for smartphones and internet access in Africa stands at 51% and 43.2% respectively. Quick response (QR) codes have also been emerging as an alternative on the rise.

Cross-domain and bank instant payment systems offer a broader array of channels, while mobile money instant payments typically favor agents, USSD, and app channels. This diversity of platforms paint picture of an evolving financial services ecosystem in Africa and caters to the varied preferences and needs of different user segments.

Another interesting point to note is that the various available payment channels like electronic money (e-money) instruments have also gained popularity in Africa. These instruments have received widespread support from mobile money and cross-domain instant payment systems.

While cross-domain systems incorporate commercial money instruments like credit and debit electronic funds transfer (EFT), bank instant payment systems primarily focus on credit EFT, with debit EFT as a secondary instrument.

For a payment system to be classified as a cross-domain system, it must have the capacity to switch between commercial money instruments and e-money instruments. Operators employ one of two approaches to achieve a cross-domain instant payment system. The ability to facilitate interoperability between banks and non-banks enables transactions across both bank and mobile money accounts, providing users with increased flexibility and convenience.

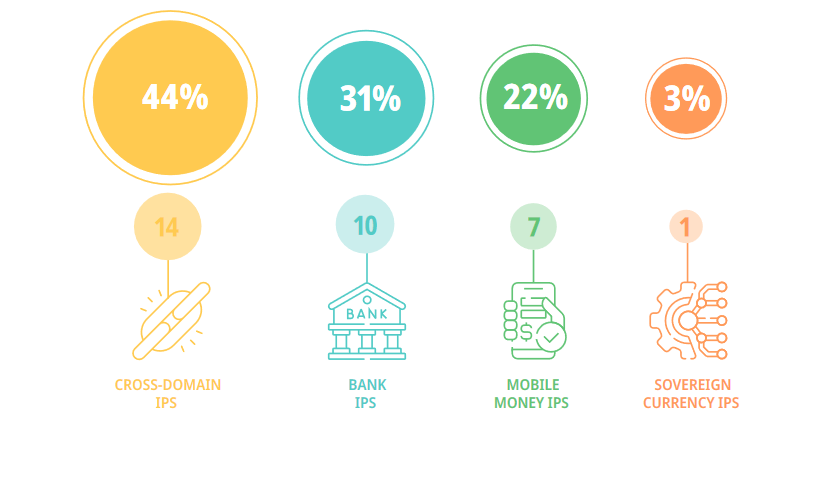

The demand for instant digital payments is growing rapidly in Africa. In 2021, 50% of Sub-Saharan African adults utilized digital payments, marking a significant increase from 34% in 2017. In fact, according to the report, the number of active instant payment systems in Africa has increased from 29 in 2022 to 32 (14 cross-domain IPS, 10 bank IPS, 7 mobile money IPS and 1 sovereign currency IPS) in 2023.

These systems include 29 national systems and 3 regional systems, such as the Pan-African Payment and Settlement System (PAPSS). The growth in IPS can be attributed to the accelerated adoption of digital financial services, which has been further fueled by the Covid-19 pandemic. In 2022 alone, IPS in Africa facilitated a staggering 32 billion transactions, amounting to a total value of approximately Sh183.90 trillion ($1.2 trillion). This represents an average annual growth rate of 47% in terms of transaction volume and 39% in terms of transaction value over the past five years.

While significant progress has been made in the adoption of instant payment systems in Africa, there are still challenges that need to be addressed to ensure the widespread inclusivity of these systems. Currently, 27 African countries do not have an instant payment feature, highlighting the need for expansion and development in these regions. However, the report reveals promising prospects, with 17 new national IPS and three regional IPS already in development. This indicates a positive trajectory towards greater financial inclusion and accessibility of IPS across the continent.

Instant payment systems form an integral part of Africa’s Digital Public Infrastructure (DPI), which aims to create a seamless digital ecosystem for individuals, businesses, and governments. DPI encompasses not only IPS but also consent networks, digital identification systems, and trusted exchange platforms. By investing in DPI, African countries can build a robust foundation for digital financial services and foster an inclusive digital economy.

USSD could be the most popular payment channel in Africa, offering a simple and accessible way for users to make payments. The rise of instant payment systems in Africa represents a significant milestone in the journey towards financial inclusion and economic empowerment.

These systems have revolutionized the way individuals and businesses transact, providing secure, convenient, and affordable payment solutions. While challenges remain, such as the need for expanded coverage and interoperability, the future of IPS in Africa looks promising. Through collaboration, innovation, and policy reforms, Africa is poised to unlock the full potential of instant payment systems and pave the way for a digitally inclusive continent.